Fresh Grad’s Compensation in Silicon Valley

This article was originally posted at Medium.

In my previous article, I talked about how researchers can improve the readability of the code that they write.

Today I will talk about something that may be interesting even to those who do not write the code yet. This blog post will be about money.

Note: There will be a lot of $$$ numbers in the text. All of them before taxes! Taxes will eat a considerable part of your compensation. There are ways to minimize the impact, but I will not talk about it.

When I was looking for my first job, I needed to answer the question: “What is the compensation I am looking for for my next role?” I did not know what to say. And I was not alone.

One of my friends, who also graduated from our department, got an offer, HR (recruiter) asked: “How much do you want?”. He took his graduate student compensation of $25k. Multiplied by 3, added a bit extra, and told her: “80k”. The HR thought for a moment and answered: “Let’s make it $100k”. I think he could tell $130–150k and start negotiation from there. But he did not do his homework, he did not understand the market to the level that even the HR person was surprised.

When you are a graduate student in the US, you are paid around $25k per year, which is fixed.

When you work in the industry, the way that you compute your compensation is more involved.

I believe that at the beginning of your industry career, it is better to work in a big tech company. In the first part, I will talk about compensation in public companies and later move to private companies, also known as startups.

Your compensation depends on:

- Geography. For the same work in Europe, you are paid much less than in the Bay area even if we talk about the same company, say Google.

- Your level. The more experienced you are, the better you are paid. In big companies, there is a structure called pay grades. Your skill is correlated with your grade, and each grade has a pay bracket. Higher bracket — higher pay.

- Company. The gap is not huge, but it may happen that even in the Bay area, Netflix will pay more than Amazon for the same work.

- Stock market. A big chunk of your compensation is equity. The stock of your company went up, you are paid more. It went down, it makes you less happy.

- Your negotiation skills.

Typically your compensation in a big tech company consists of:

- Base pay: a fixed amount of $$$. It varies between $100k-200k per year for most of the people.

- RSU: equity that you can sell at the stock market. The more skilled you are, the more significant part of your compensation it is.

- Sign bonus

- Performance bonus

- Stock refreshers

Good blog post on the topic: What is compensation made of.

Important to mention that the question: “What was your offer?” differs from the question: “How much do you make?” People confuse this a lot.

Grades

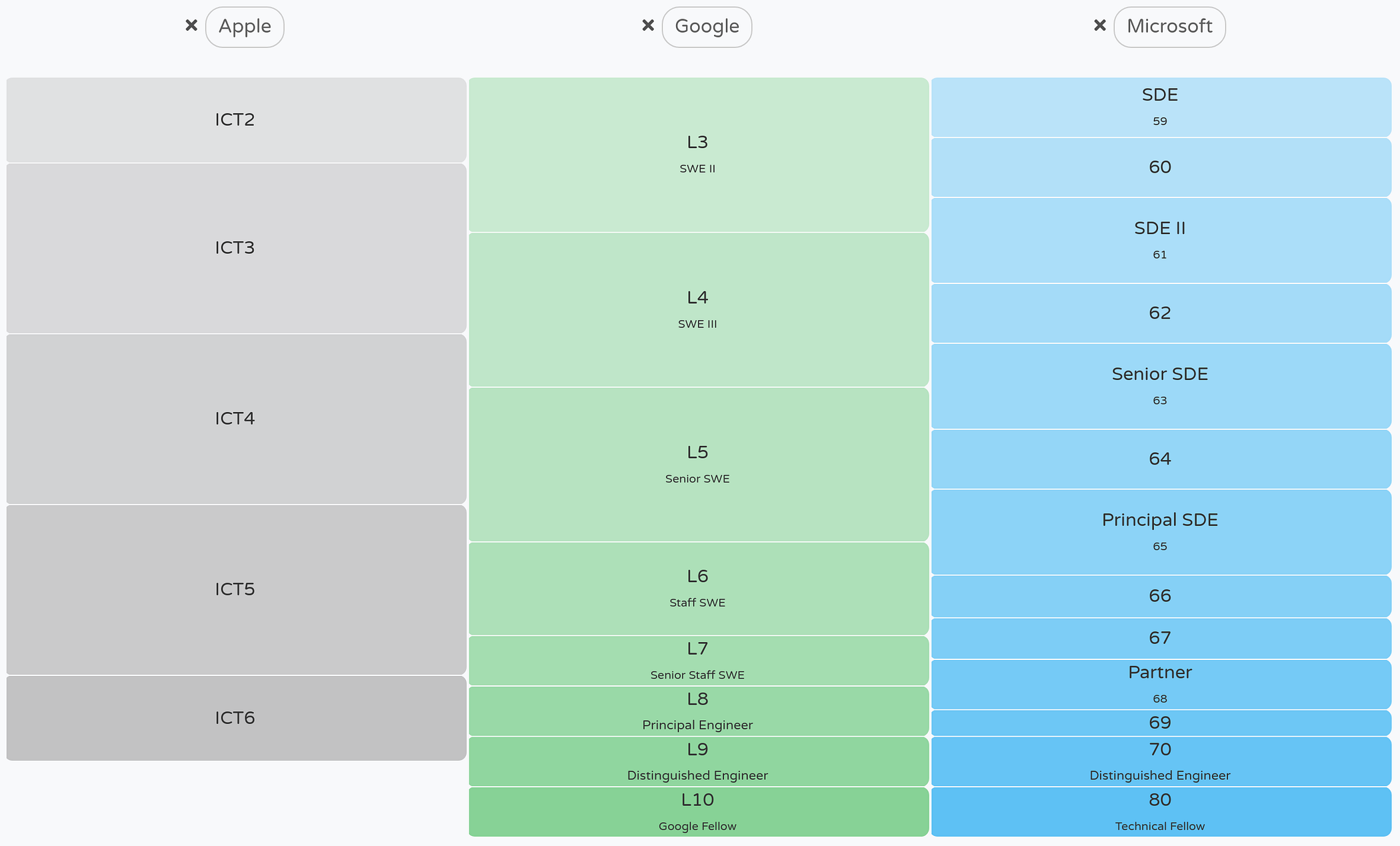

At some point, companies introduce the formal structure for the employees’ skillset. It is called grades or levels. You will see it in all the big companies. Different companies have different notations for a grading system. Levels.fyi provides a decent mapping from one notation to the other.

The most widely accepted is the one used by Google, Facebook, Lyft, Uber, and others.

- L3: Junior

- L4: Middle

- L5: Senior

- L6: Staff

Q: What about people that have big tech companies as their first industry full-time position? What level will they be considered?

A: Fresh grads without a Ph.D. are considered for L3. Fresh grads with a Ph.D. are considered for L4.

Q: Is it true that researchers are paid more than engineers?

A: No, it is not. Pay grades are precisely the same.

Q: What if you have a Ph.D., have 100500 publications at the top conferences, and move to the industry, will they consider me for L5?

A: If you get an offer, it will be an offer for L4. Publications may improve your chances of getting into the interviewing pipeline, but they will not affect the $$$ in the offer.

What are the numbers?

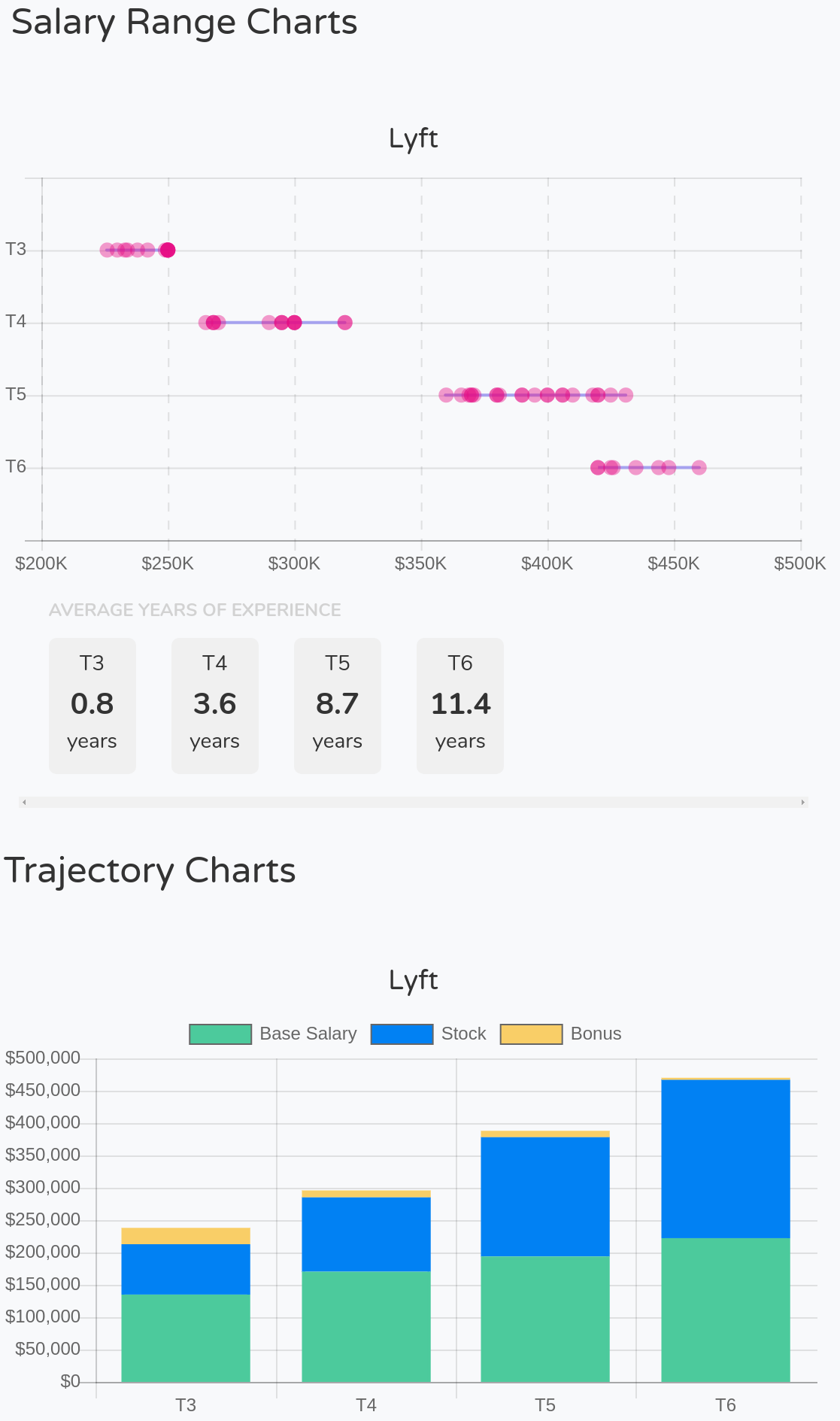

Let’s look at Lyft, Levels.fyi.

Total compensation = base + stock + bonuses

https://www.levels.fyi/charts.html?search=lyft

- L3: $230–255k

- L4: $270–320k

- L5: $366- 445k

- L6: $420–460k

- Your compensation is not fixed. It is changing every day.

- You may get promoted. You go to the upper grade. Your base pay goes up, and you get an additional stock grant.

- You may get a bonus. Companies regularly give some money to the employees based on their performance. Typically once a year, in winter.

- If you perform well, you get a stock refresher. Typically once a year, in winter.

- The stock of your company may go up or down.

Example A

An engineer joined company A on July 7, 2019. She got $150k as a base pay and stock grant of $400k RSUs with a four-year vesting schedule. A four-year vesting schedule means that the employee will get only a quarter of this after the first year. RSUs are not measured in $$$. They are measured in the units of equity. On July 7, 2019, the stock market price was $60 per share, and she got a stock grant of 6666 shares.

She expected to get for the next year of work $250k = $150k +($400k / 4).

July 7, 2020, if she sells RSUs with the current stock price of $30 she will get:

$150k + ($400k / 4 / $60(last year price)) * $30(this year price) = $200k

The reality was worse than expectations.

Example B

Software Engineer accepted an offer to company B: base $150k and a four-year grant for $400k RSUs.

She expected to earn $250k this year, but it turned out much better:

$150k + ($400k / 4 / $230(last year price) * $1389(this year price)) = $754k

The same initial offer, but the outcome is quite different.

Was it obvious the year ago that it will turn out that way? Not really. Do we know what will happen in the future? No, we do not. Timing stock markets is a bad idea.

Q: I joined the company as a fresh grad with Ph.D. How long will it take to get promoted to L5?

A: It depends. You are not entitled to a promotion. You may get promoted, or may not. If you are not promoted from L4 to L5 in 3 years, you need to consider another role or another company. Hopefully, you will be able to realize your potential there.

Q: Compensation numbers for L6 look attractive. How long does this take to get promoted from L5 to L6?

A: L5 is the terminal level. 90% of the employees never get above it. Let’s say best case scenario - another 3 years. More realistic - it will never happen.

Q: What should I expect as compensation when I will get an offer?

A: As a first step, you need to get the offer. The interview process is very competitive, and no one likes to hire fresh grads. No one in the world knows how to set up the interview process well. Weak candidates get offers, strong candidates get rejected. Hiring strong talent at scale is a very complex problem. It is hard to estimate how productive the candidate will be in a few hours that the team spends talking with him. The strength of the candidate and his ability to pass interviews are not perfectly aligned. For fresh grads, this is even more random than for seniors.

Internships help to mitigate this problem for people from academia. During the internship, the candidate works on something close to the problem that the company is facing, and he does it in collaboration with full-time employees. As a result of the internship, the person may get an offer for a full-time position. The vast majority of the offers for fresh grads in big tech companies are through internships.

If you have more than a year till graduation, you need to focus on getting internships. It will help with your skills and your career. As a bonus, it will also help you financially. In graduate school, you are paid around $2000 / month, and as an intern, this number will be around $9000 / month.

Q: What will matter the most for the $$$ in the offer, my great publications, or my internships.

A: Internships.

Q: If I will get an offer. How can it look?

A: Just check level.fyi for L4 and look for the lower part of the range.

How to negotiate a better offer?

I am not an expert. Every time I accepted an offer, I felt that the recruiter manipulated me to take something lower than I could get.

- Great blog post: Ten Rules for Negotiating a Job Offer.

- The book about negotiation that I recommend to everyone, even if you are far away from the job search process: Everything Is Negotiable: How to Get the Best Deal Every Time.

In general, there is a couple of basic advice.

The most important is to get offers from many different companies. It will make your position stronger and help companies understand your market value, measured by an external source.

Do not say the number first. The company should do it. Negotiation is based on the asymmetry of the information. It is not your obligation to share anything unless you want it.

Standard questions that help companies to calibrate your expectations:

- How much do you make now? This is illegal in California, but recruiters still do it.

- What do you expect for your next position?

- What are the offers that you got from other companies?

- This is my favorite: “What is the minimum number that will make you accept the offer?”

There are exceptions to all these rules. When people contact me with a proposal to interview for a position that they have, I clearly state my expectations about the compensation. They disappear, and this saves both of us a lot of time.

Compensation in startups

As I mentioned above, I believe that it is better to work in a big company until you reach L5 (senior). And it is not because of the money. At the beginning of your industry career, it is just a more efficient way to learn.

There are several reasons why working in a startup is a good/bad idea. Here I will talk only about money.

Startups are different. You may classify them by the number of people that work there. There are other classification schemas, for example, based on their last funding round, but let’s stay with the number of people.

Roughly, you may think about company maturity stages as:

- Family

- Tribe

- Town

- City

Every stage has a different culture, processes, people. Pretty often, the company’s executive team is changed when a startup goes from one stage to the other.

“The city” is similar to big public companies. “Family” is a stereotypical Silicon Valley garage-type endeavor.

My first two positions were in the startups of around 50 people (family/tribe) when I joined them.

Let’s imagine that you will get an offer from a similar size startup. What is the expected compensation range?

For a Data Scientist / Software Engineer, you can expect the same base pay as you would have in a public company of $120–150k.

The equity component is trickier. Most likely, you will be offered a grant of 0.1% of the company with a four-year vesting schedule.

Side note: Some startups, typically those that are sketchy, will tell you: “N shares for 4 years”. N - as a number is useless. You want the percent of the company, i.e. to know N out of total M shares. You need to ask: “What is the total number of shares?”. If the company refuses to tell you this is a big red flag.

The private company’s stock is called “paper money” because, for the vast majority of the startups, it will be as valuable as toilet paper.

0.1% of the company, is it good or bad?

Remember, in a big company, you will get a grant for $150–400k. Let’s use the number of $300k in our discussion.

In a public company, you get an offer, you work for 4 years, you do no get promoted, but you do not get fired, and you get your $300k.

What about startups? What is the path to the $300k from your equity grant?

Your 0.1% will convert into cash if:

- A company becomes public. Example: Lyft. Only after a march of 2019, the equity that employees had could be converted into $$$.

- The company gets acquired by a public company. Important! Not acquihired. And not by another startup! If your startup is acquired by another startup, you will convert paper money from one company to the other’s paper money.

Book on the topic: Secrets of Sand Hill Road: Venture Capital and How to Get It.

Imagine that the miracle happened, and your company became public, you got $300k for your 0.1%? And let’s forget about ~20% dilution of your percentage on every financing round.

$300k / 0.001 = $300 million (It is unlikely that investors will allow the company to go public for the valuation of $300 million, but let’s also forget about it.)

If you joined at L4 (middle) and worked for 4 years so good that you were not fired but so bad that you were not promoted, you will get $300k, starting from the first year, and all $300k will be on your account in 4 years.

If you joined a startup as a 50th person and worked hard, and that startup survived till IPO (very unlikely), it will give you $300k. But not after your four years! It takes around 10 years for the company to become public. Hence your work hard for 4 years and wait for a few more years to get your money.

This deal does not sound right. What about all these people that became millionaires, joining at early stages?

Let’s calculate the IPO price for the company that gave $10,000,000 for your 0.1%?

10m / 0.001 = $10 billion. Every year a few companies become public with this or higher valuation. I would guess that in 2019 there were around 10 such big IPOs.

How many startups are there in the world? What are the chances that the startup that gave you an offer will be one of these successful 10?

I am not saying that this does not happen. After three years of work in a company that became public last year, one of my friends got enough capital that he does not need to think about money until the rest of his life. I know thousands of people, and he is the only one who got this lottery ticket.

Basically, on average, from a financial perspective, being a low-level employee in a startup sucks. You will rely only on your base pay. And you will not be able to use your paper money to pay rent.

But there is a caveat.

There is a quantity called “Fuck you money.”

Fuck you money

Fuck you money is a fancy way of saying enough money that you’re completely financially independent. You can say “fuck you” to an employer or a business proposition, and it won’t affect your living standards noticeably.

“Fuck you money” will not make you happy, but financial independence is a desirable state.

This number is not well defined, and it depends on geography. In the Bay area, it is probably around $10,000,000.

You work at a public company, you are better than average, you are L6 (Staff), and your total compensation is $500k / year.

After taxes, you have $300k / year. You spend $100k on rent, clothes, food, beer, and vacations the rest of $200k you put on your checking account or invest in index funds.

To get to the “Fuck you Money” stage, you need 10m / 200k = 50 years.

If you invest in the index funds, this number goes down to 23 years, that is better but still.

You are young, and you do not want to wait that long.

Startups offer another path, which is one of the reasons why people leave big companies for smaller ones. (Typically, it is not the main reason. There are plenty of reasons that are more important than money.)

When you get to L6, you are not junior anymore. You have what is called a career capital: good networking, technical, product, and marketing skills.

And this means:

- You can avoid many pitfalls and choose a startup that has a higher chance of success.

- Fresh grads go for junior/middle positions. L6 from FAANG (Facebook, Amazon, Apple, Netflix, Google) are often hired for Head of Data Science, Director of Engineering, Chief Data Scientist, or similar high-level positions. This leads to a more significant impact on the company’s performance (more skilled and impactful you are, more chances for the company’s success) and much larger than a 0.1% equity grant.

In the big public company, your chances for “Fuck you money” are zero. In the wisely chosen startup that you join when you have a solid “career capital,” they are much higher.

As a fresh graduate, you should not worry about it. You should aim for big tech companies and go for startups only as a temporary measure while interviewing for more mature ones.

I want to emphasize that money is not everything. I recommend getting to the L5/L6 level in the big tech company first and consider going for the startups later, not because of the money, but because of the shape of the learning curve.

I hope this blog post clarified the rules of the game to have a better understanding of what is “normal” and what is “expected.”

Special thanks to Tatiana Gabruseva for the help with the blog post.

Comments